Financial Statistics Summary of China's Jewelry Listed Companies

Caibai Jewelry benefiting from both internal and external factors

Caibai Jewelry, which was officially listed on the A-share market in 2021, released its annual report. Showing strong growth during 2021, the influential jewelry brand also made great progress in the establishment of a sub-brand matrix, enhancement of brand influence, as well as channel expansion.

The company recorded revenue of 10.41 billion RMB, up 47.23% compared to 2020, which reached record levels over the period. Net profit increased by 0.61% YoY to 364 million RMB.

The company pointed out that the recovery of consumption power, the fluctuation of the gold price, the accelerated expansion, and the diversified channels were the main drivers of the increasing demand. Meanwhile, the consumers also showed preferences for high-margin commodities, fueling the sales.

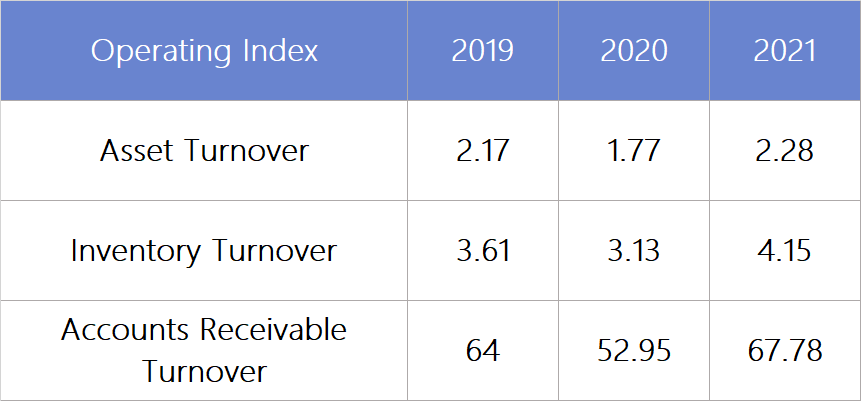

Regarding the operational capability indicators, the internal operational efficiency of Caibai was significantly improved in 2021, with all the three indicators reaching the highest level in the past three years.Table 1. Operating Index from 2019 to 2021

Bridal Jewelry brand Darry Ring showing impressive growth

Darry Ring (DR) released its 2021 financial report. With outstanding brand power, DR kept attracting attention from the capital market. The company focusing on the bridal diamond products showed impressive growth and profitability, with revenue increasing 87.57% to 4.62 billion RMB, and net profit reaching 1.302 billion RMB with an increase of 131.09%.

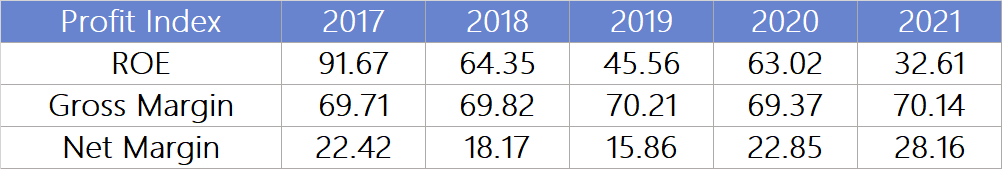

Although with the successful IPO and net fundraising of 4.44 billion RMB, the ROE index declined to 32.61%, DR remained in healthy operating condition.Table 2. Main profitability index of DR in 2017-2021

In addition to the financial index, same-store sales for direct-sale stores rise 41.83% to 10.18 million RMB, and gross profit reached 6.79 million RMB, with an increase of 42.94% over the same period of last year.Mclon Jewelry seeking sustainable development instead of expanding boldly

Mclon Jewelry released its 2021 annual report. In the past year, the company optimized the products, and upgraded the management and operation of data in the past year, leading to the great improvement both online and offline.

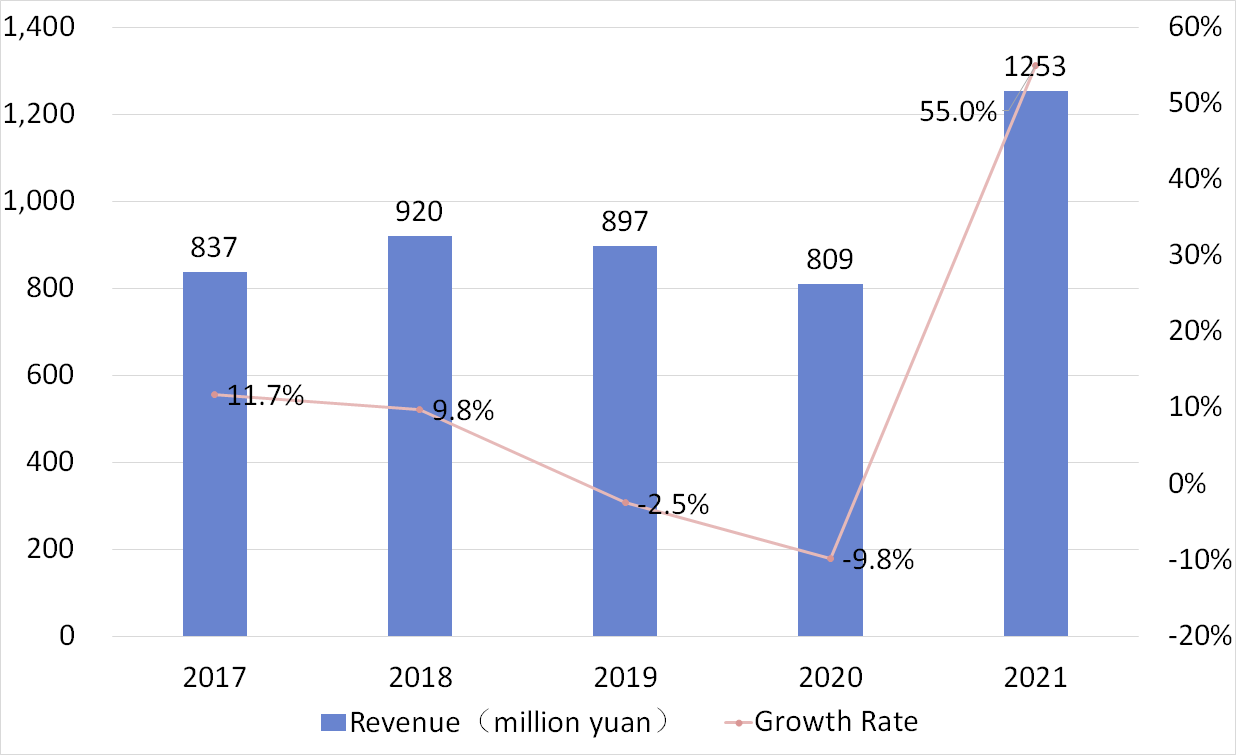

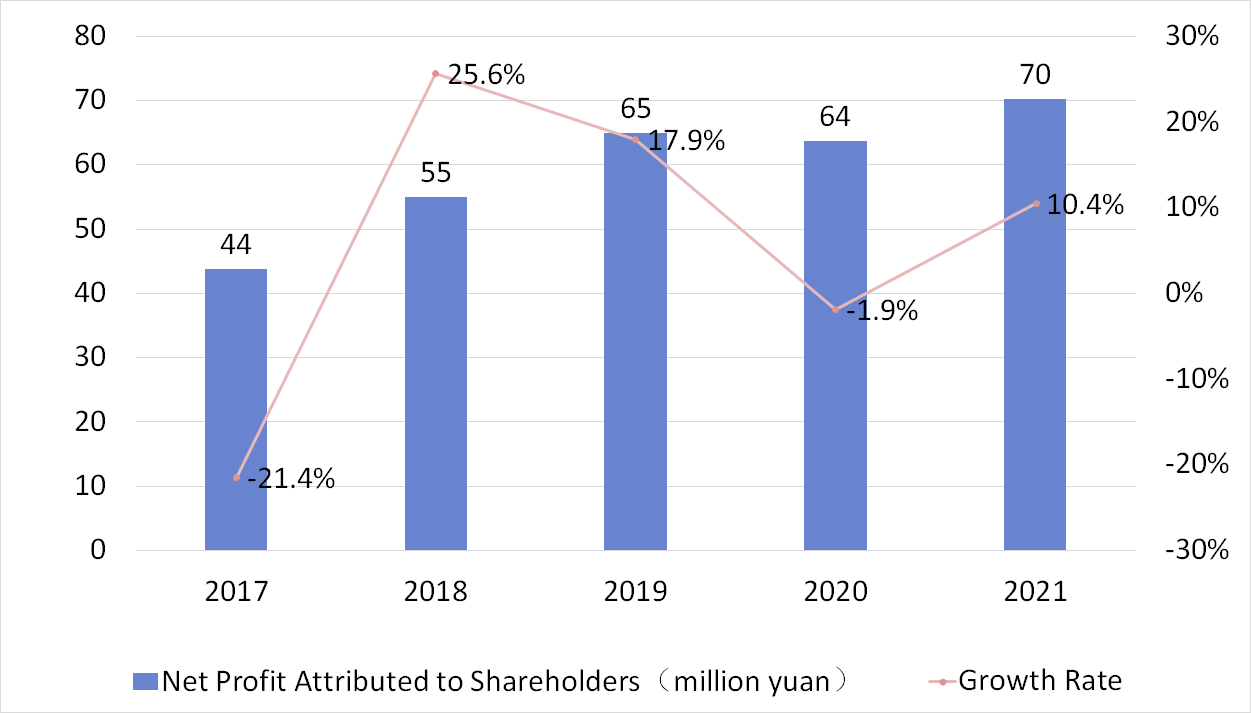

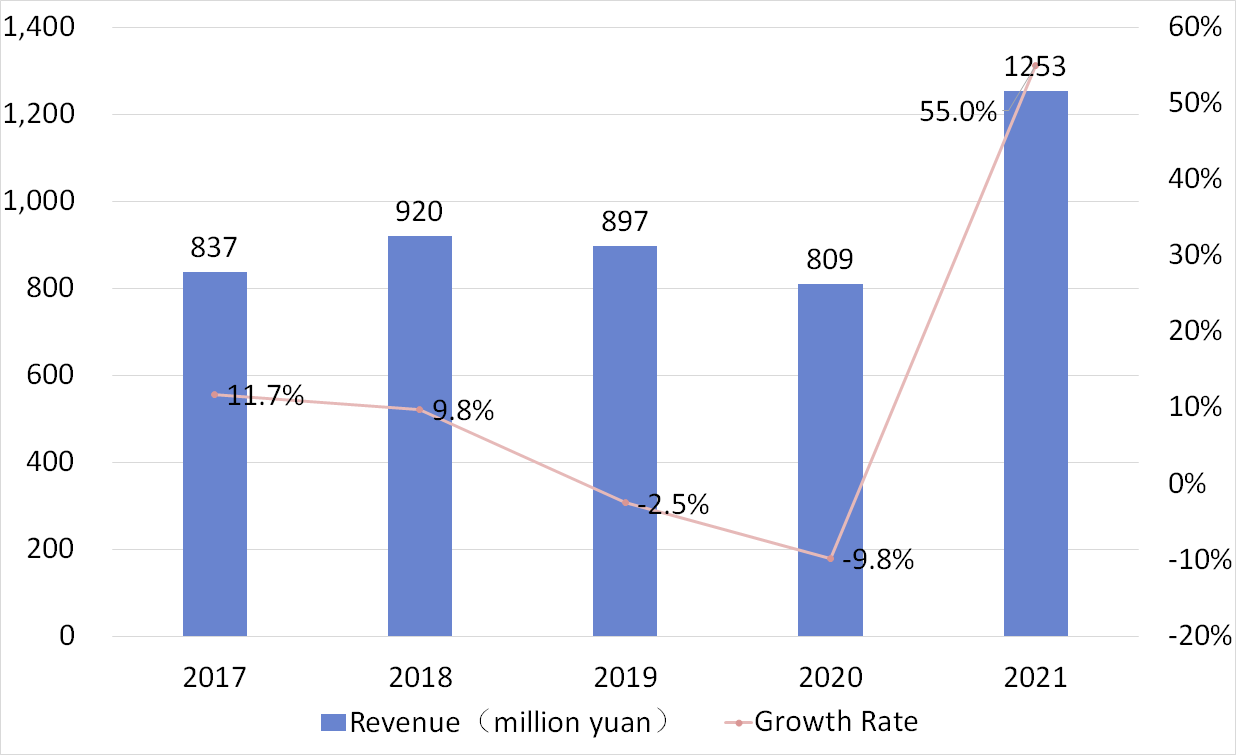

During the reporting period, the company realized revenue of around 1.25 billion RMB, with an increase of 54.90% compared to 2020. The net profit attributed to shareholders was 70.29 million RMB, raising 10.43%.

Figure 1. 2017-2021 operating revenue of Mclon

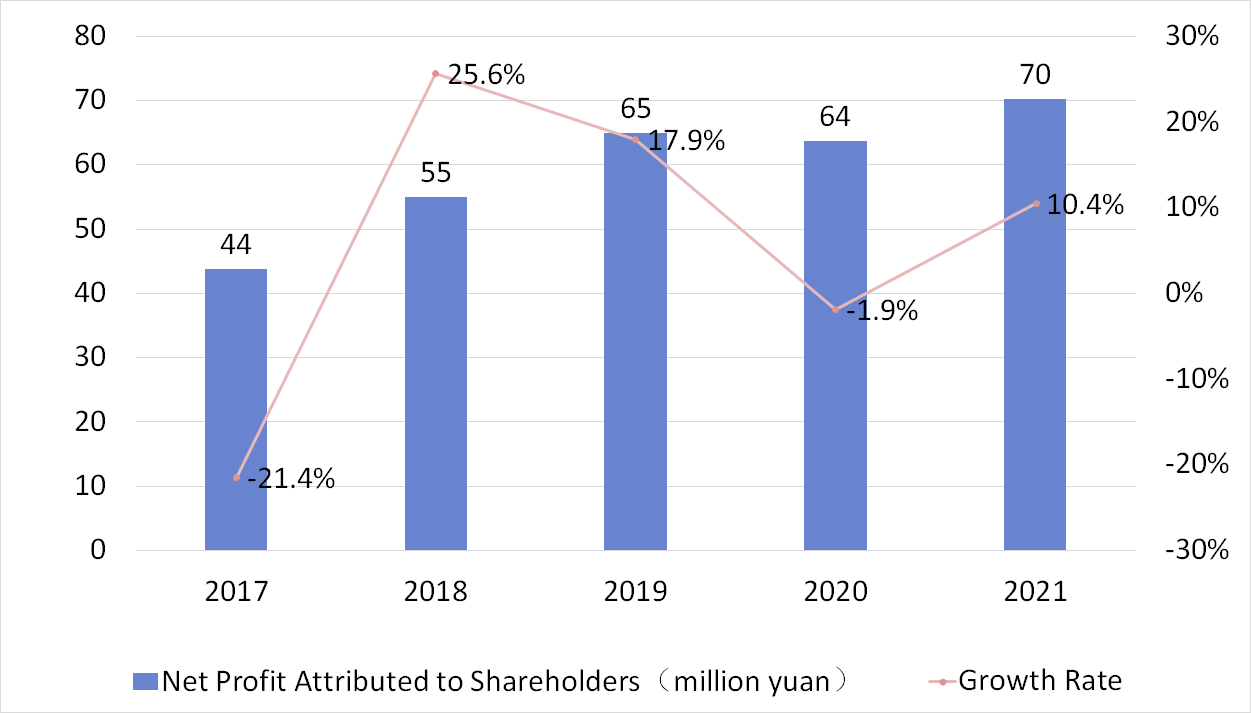

Figure 2. 2017-2021 net profit attributed to shareholders of Mclon

Over the past five years, the CAGR of Mclon's operating revenue was 10.60%, with the revenue changing at a relatively stable level. The CAGR of the net profit was 12.54% from 2017 to 2021, maintaining an upward trend.

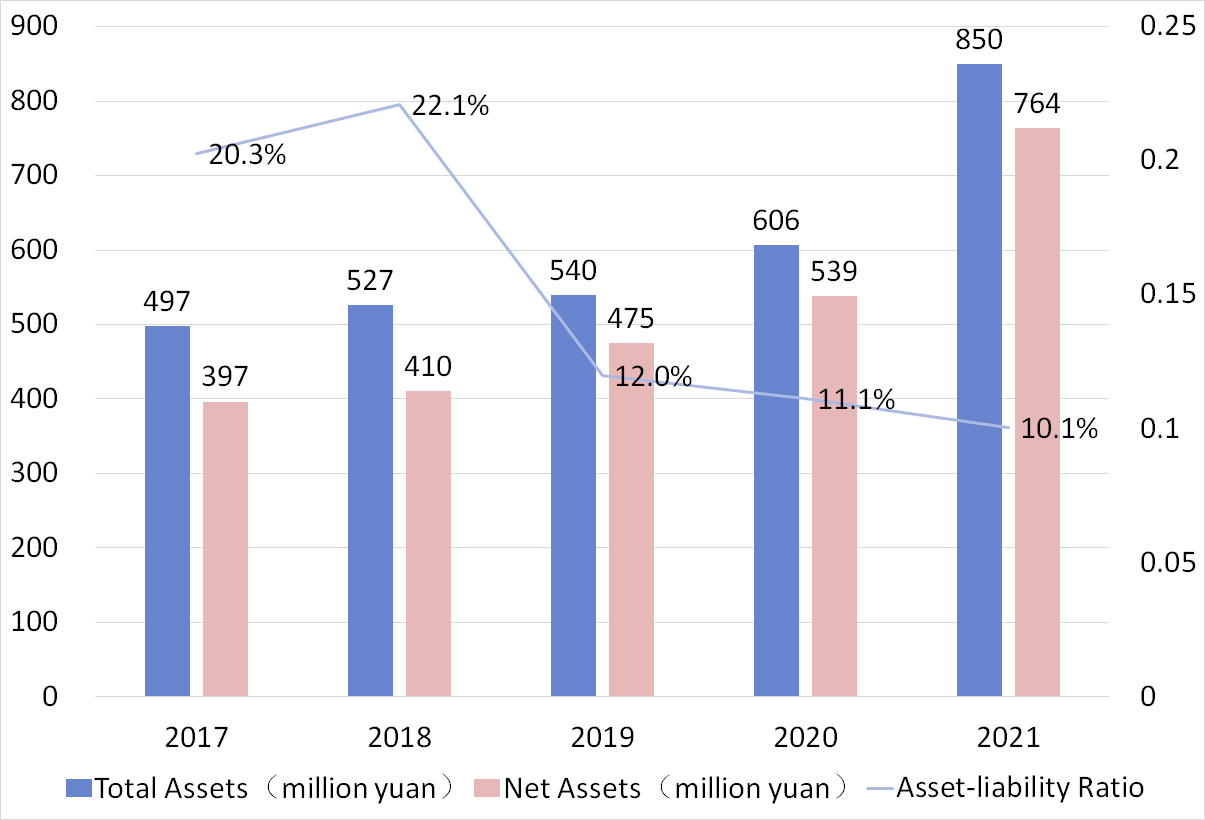

Figure 3. 2017-2021 asset of Mclon

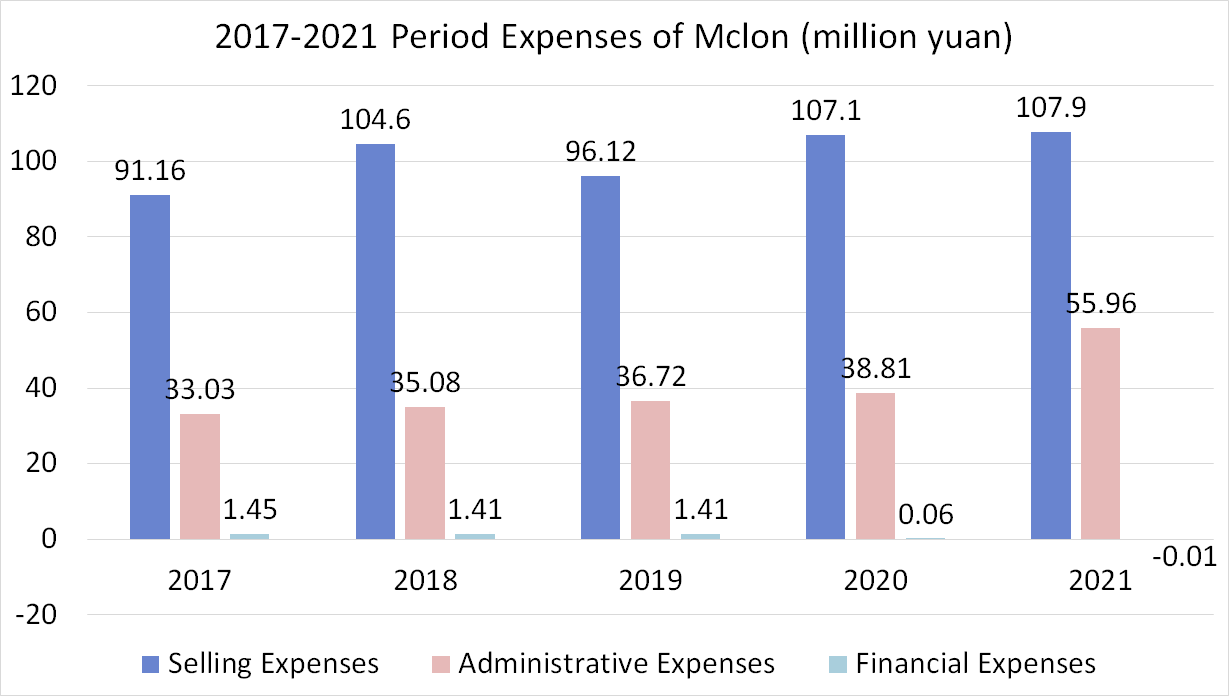

Due to the steady development of the business, the asset scale increased while the debt maintained a low level, leading to low financial expenses.

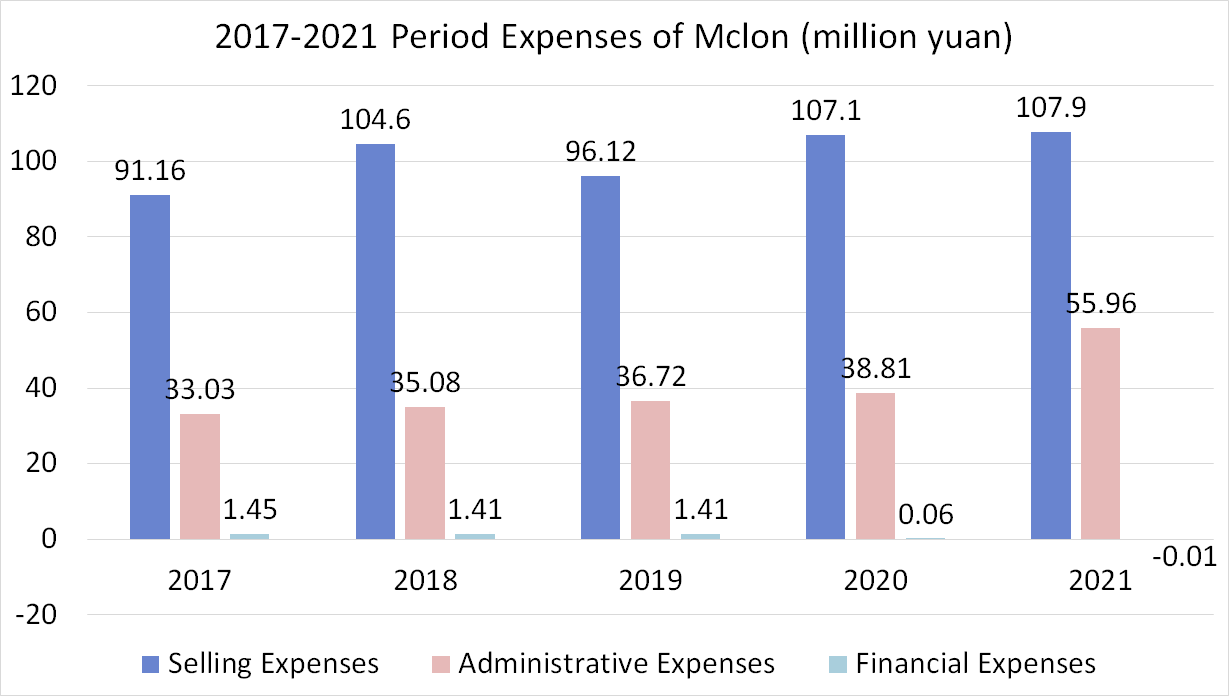

Figure 4. 2017-2021 period expenses of Mclon

Figure 4. 2017-2021 period expenses of Mclon Keeping the expenses stable, Mclon has always adhered to a sustainable marketing strategy even after successful IPO,which means the company did not blindly pursue the expansion of business scale nor invested too much in marketing expenses.

Chow Tai Seng experiencing strong performance

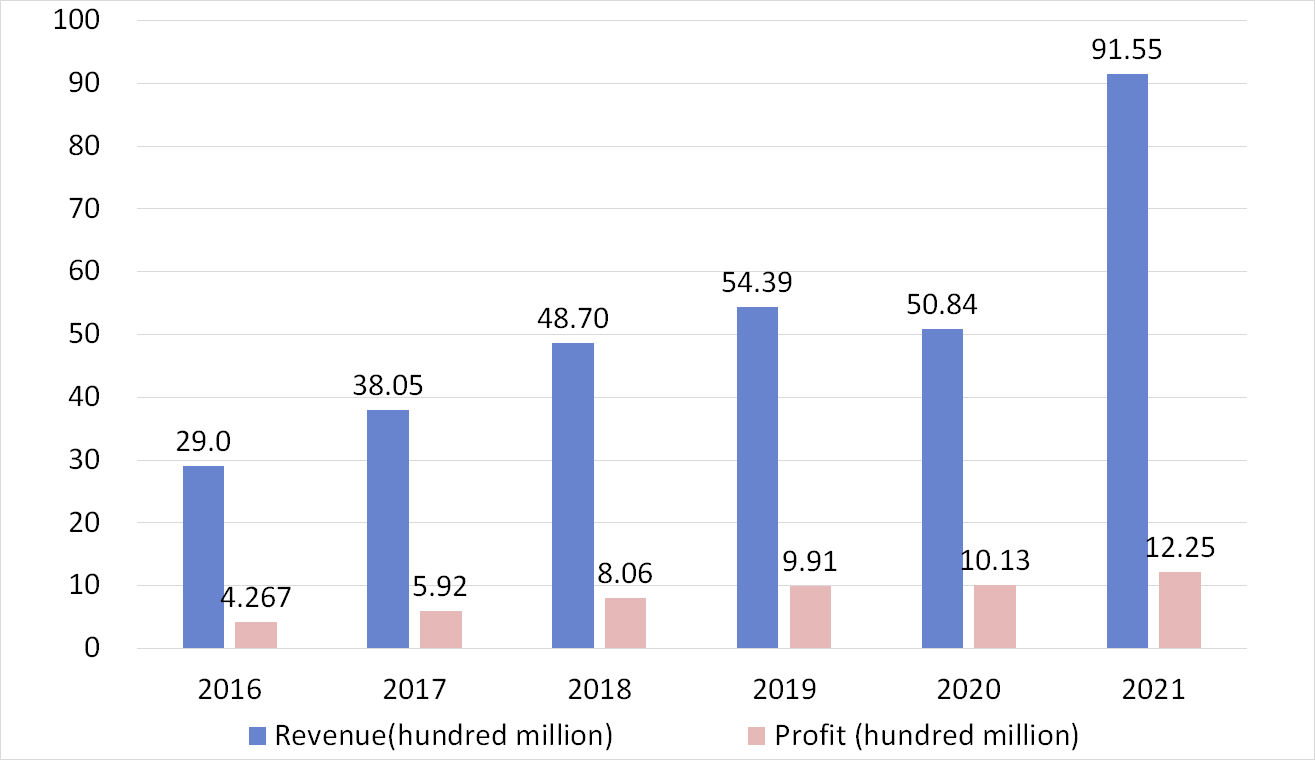

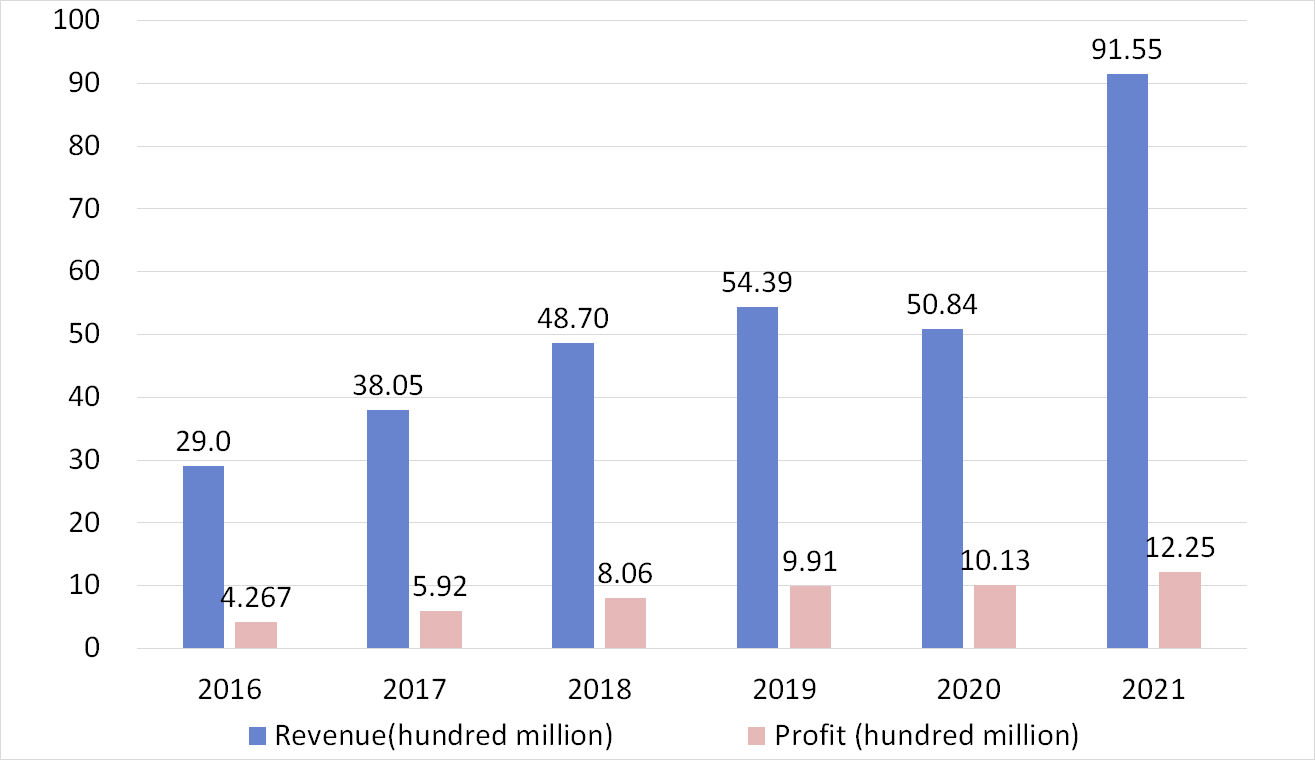

Chow Tai Seng recently released the 2021 annual report. During the reporting period, the company's operating income soared by 80.07% to 9.155 billion RMB, and the net profit attributable to shareholders increased by 20.85% to 1.225 billion RMB.

In terms of revenue structure, self-operated offline, self-operated online (e-commerce), and franchise businesses contributed 13.76%, 12.54%, 71.24%, respectively. Due to the substantial increase in gold income, the proportion of plain gold products increased significantly, accounting for 60.79% of the operating income.

By the end of 2021, the company's terminal stores increased by 313 to 4,502, including 4,264 franchise stores and 238 self-operated stores.

Figure 5. 2016-2021 Revenue and Profit of Chow Tai Seng

Figure 5. 2016-2021 Revenue and Profit of Chow Tai Seng